Drawndowns and Pain – What to do when positions go against you

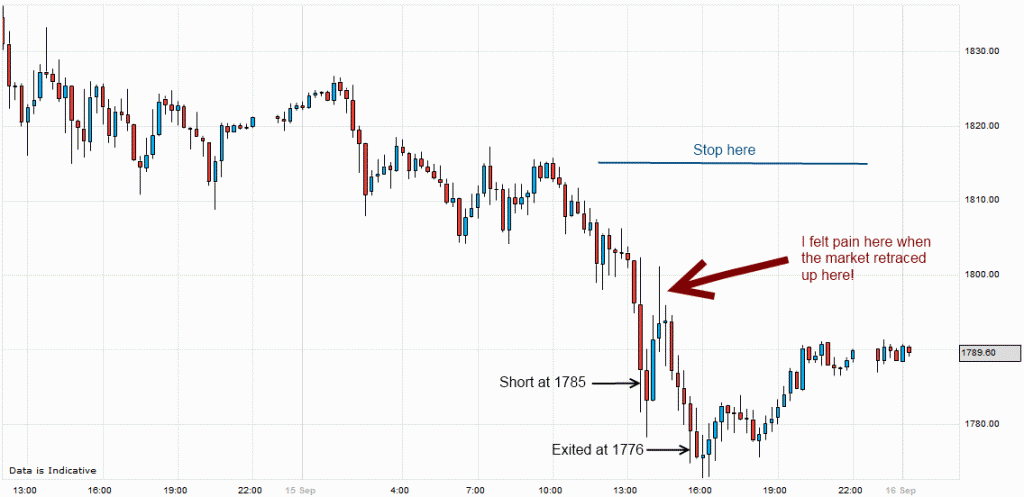

Today I entered short on Gold after seeing a breakdown in the price action. My stop was in the correct place but what I hadn’t anticipated was how much money I could have lost when I placed the trade.

I only realised what I had done after I had placed the order and it got triggered. I usually can deal with a 100 point (or pip) loss which amounts to around 2% of my capital. However, I had gone in at the same stake size as my normal trades but my stop was also the equivalent of 250 pips away which is 2.5 times my usual risk… a 5% risk on my capital which is a large amount for one trade.

Needless to say, when the market fell and retraced and went to 1800 or so, I was already 150 points down which felt extremely uncomfortable. Monetary wise, I would never see this amount in the red in my account.

Luckily for me, the market fell after this and I managed to get out at 1776 which was an equivalent of a 90 point move. I was expecting Gold to move a lot lower but the price action made me feel uneasy.

Anyway, for future there are things which one needs to be aware of to make sure you don’t risk too much and trade within your trading parameters….

- If your stop is wider that what you’re used to, scale down lot or pip size to attain your max loss amount per trade. In this trade, I should have scaled my usual size down by 2.5 times

- If it is too expensive to trade a particular trade due to wider stops or larger capital requirements, simply don’t trade it! There will always be opportunities!

- Look at your Risk/Reward ratio… is it worth you putting on the trade?