The Importance of Having your Stop in the Right Place – Trading the Financial Markets

I wanted to put this post up to remind myself of a lesson which I seem to have forgotten and cost me today and that is… “ensuring that your stop is in the right place”

To be honest, I got a bit lazy and have been putting stops with my orders with no real analysis as to where they should be. I know some people and some of the systems that I use do have a fixed stop limits but this way of trading for me involves putting in stops in the correct place.

A stop is your ‘yes, I am definately wrong‘ scenario where the price action as confirmed that your analysis is wrong and that it’s time to get out. I want to show you with my real life example below:

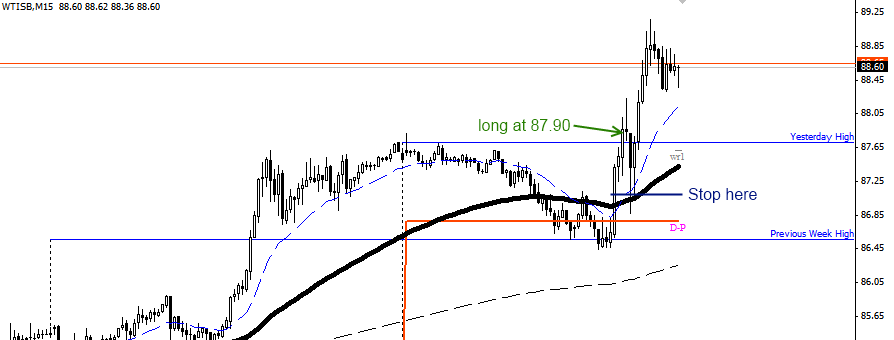

I had my order at 87.90 today on Oil. This was a break above yesterdays high and I thought that the price would rocket up from here… very little resistance after clearing this area. My entry triggered and started to move up. However, within 20 minutes or so the price action fell, hit my stop and reversed.. if I was still in the trade, the price had already reached a 150 point profit with more to go….

However, look at where my stop is. I thought 80 points should be enough room for the market without taking consideration the following:

- Stop hunters – these people will drive the price action to where most people have their stops (this is usually a few points from support/resistance lines) before the price reverses

- My stop should have been either under the moving average line, under the Daily Pivot or under the last Trend Reversal (86.45) – it was neither at any of these, it wasn’t even behind the first line of defense!

- Market news at 3pm UK time (which is when the spike occurred) – perhaps should not have traded until the news had passed

I was really annoyed with myself when this happened… so close yet so far! Ugh!

After analysing charts a great website to trade on is a smart options website. There you predict if a stock/commodity or anything else will go up or down within a given time frame. You get a 22 pound bonus sign up as well, visit http://www.onetwotrade.com/?IB=2018219