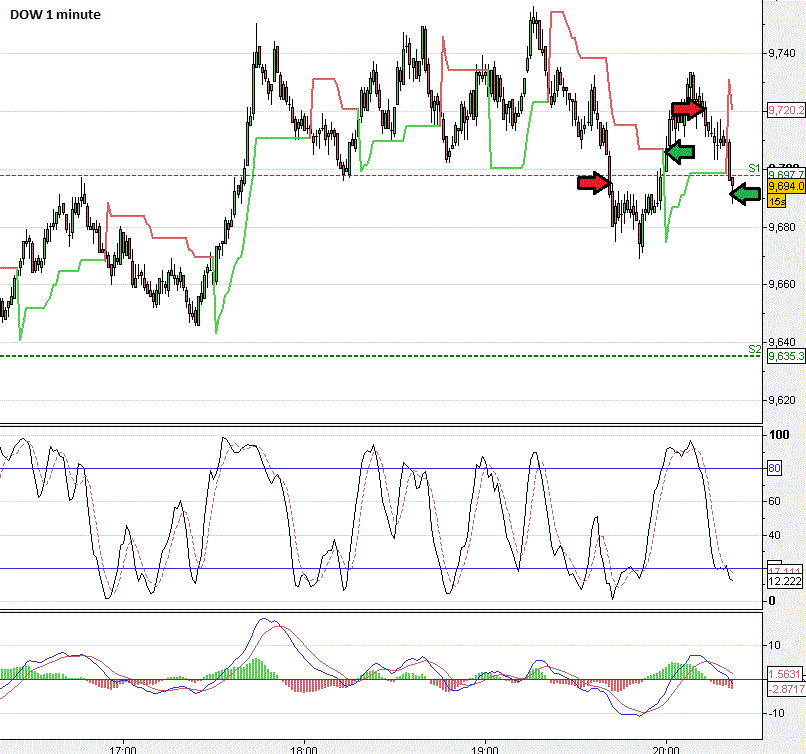

False break on the DOW

Well, back to trading the DOW, I was looking scalp for a few points and initially had my mind fixed on taking 30 points…

I was looking to see if the DOW would break below the S1 pivot point which was also a support line the DOW had responded to earlier. I place my entry at 9694 just to be sure it was lower than the previous low point set. The market gave me my trade and it went nicely the right direction.. I had set my limit to be 9664.

The market however didn’t want to give me my 30 points…. I could have grabbed a maximum of 24 points but when the market looked funny, I was contemplating exiting for 10 points or so. 10 points didn’t seem worthwhile for my trade size and I’d just be kicking myself if it tanked from here so I left it. I ended up losing this trade with a 15 point deficit.

However, I had a second entry.. seeing that the market had made a short term top, both stochastics and MACD looked ripe for the picking I went short. I was aware of the S1 level again but wanted to see what would happen. My stop at this point was 9470 and this time I didn’t fixate 30 points in my head.. I just wanted to ride it as long as I could, until instinct got me out. I ended up getting out with 19 points (the spread was moving so much I didn’t get as good price as I would have liked)