-

I was looking at triggers for a trading strategy and asked AI to give me some ideas.. here's what it said

Here are several potential trading trigger ideas that could capitalize on momentum and market psychology:

Failed Double Top/Bottom Pattern

When a second peak/trough fails to r

Read Full Story

-

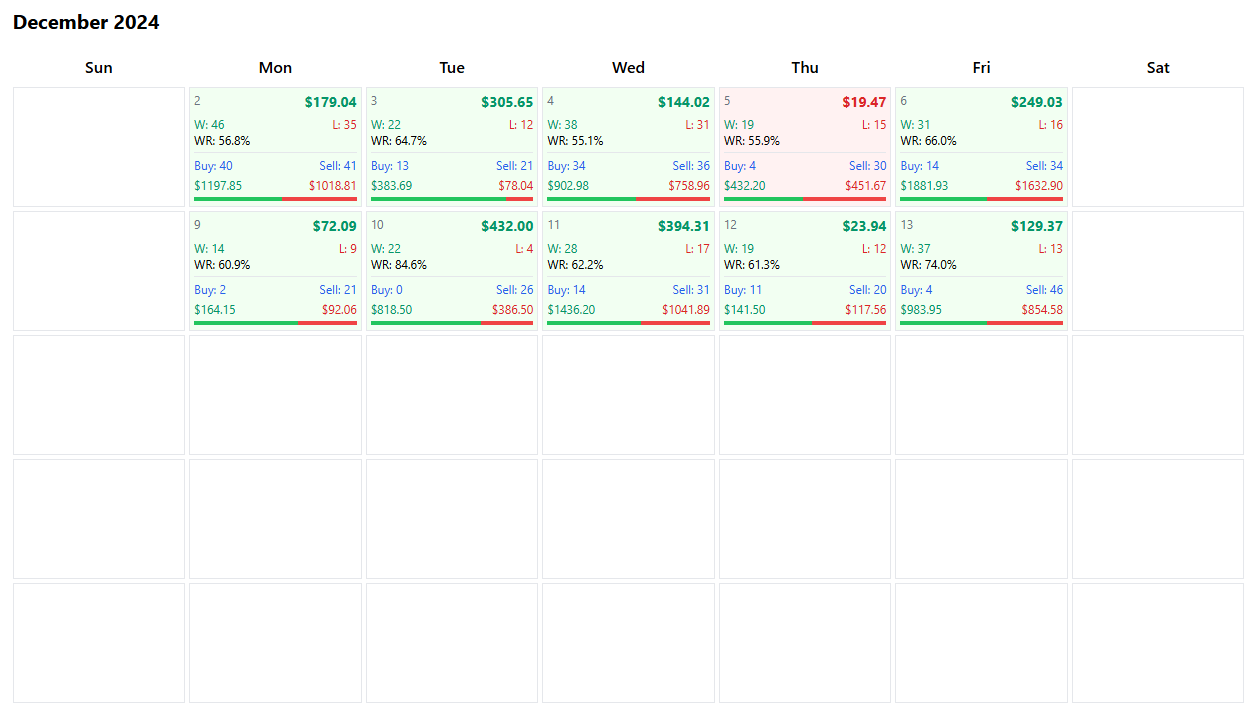

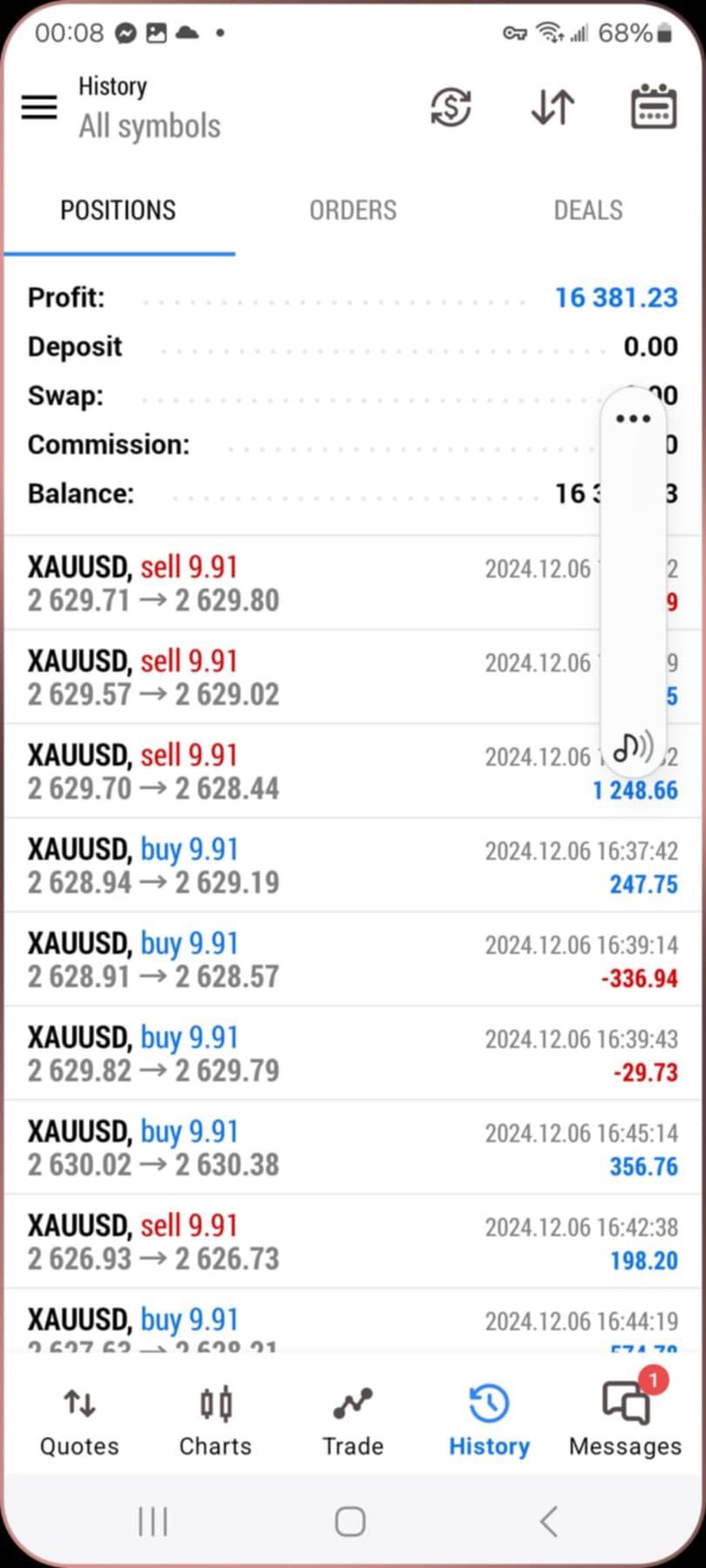

So I've been using the Dow Strike trading robot now for a couple of months and here are the results! 37 days of trading, 34 profitable and 3 losing.. made a total of $12,821.58 on a $100k account.. that's a 12.8% return in 2 months! It's particularly active from the US open and can open up 20-50 tr

Read Full Story

-

I have an associate, some guy I met online who I talk to about trading... he's an interesting character and one of the best traders that I've ever known. I'd like to say he's a friend as we do share a bit of information about each other besides our interest in trading but I've not met him in person

Read Full Story

More Articles

City AM published their list of the top 40 people who work in the hedge fund industry under 40. You can read the whole thing by downloading the City AM article here: http://www.cityam.com/issue/2011-05-16

A lot of these guys are in their early 30s and doing so well... I'm in the same age group and I guess it makes me feel kinda inadequate!

Anyway, for your reading, check the link or here's the cutting from the newspaper.

May 16, 2011

No Comments Full Story

It was another good day on the markets.. it's funny how you get periods when your systems don't seem to work at all and then when they work, everything works nicely. A big part of that is because the markets are always changing... the go from trending to non-trading, from trending up to trending down. Most systems work for a particular type of market... it's difficult to find a system which works across all of the markets volatile personalities.

Anyway, I had two trades on the GBPUSD today...

May 6, 2011

No Comments Full Story

The pivots today were all very significant in trading today.. if you look at the blue pivot line in the charts below for all trade instruments (GBPUSD, EURUSD and FTSE), you can see how the price action reacted to the pivot line.

With the GBPUSD chart you can see how the market bouced off the pivot line at around 8am... shortly after this I went long which wasn't a good trade as I ended up with -20 as the market went down. However, on hitting the pivot again, you could see that it provided no

May 5, 2011

No Comments Full Story

« Older Entries

Newer Entries »