Trading the S&P

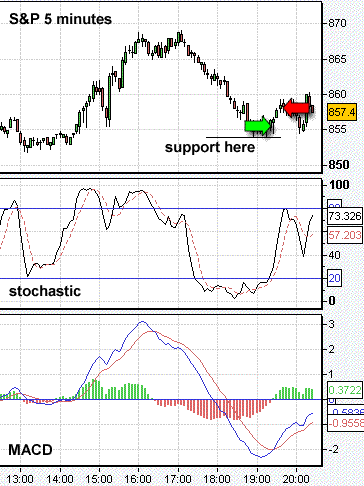

I saw an opportunity on the S&P, the price action had found a temporary base at just below 855 and the stochastics and MACD were indicating that a turn maybe on it’s way. I am always a bit hesitant when trading the S&P as my stake size has a minimal size. However, when one sees an opportunity, a good trader needs to take it… so, being the best trader that I could be, I went for it and went long at 856 or nearabouts.

My two winning trades on GBPUSD and GBPJPY means that I had profit in the bag and if I end up losing on this one I know that I will get annoyed. It’s always nice to finish with an ‘up’ day… and if I’ve already bagged profits, then why should I go and try and trade again risking profits? Well, as I mentioned, a good trader needs to take opportunities when they come.

My initial target was 860 but when it looked to flag, I got out at 859. The market then dropped to near the support line again before bouncing up… if I was still in this trade, my target of 860 would have been hit but it could have easily not been.

So, +3 points on the S&P also with 3 out of 3 positive trades in the bag today!! Great stuff 🙂