-

I was looking at triggers for a trading strategy and asked AI to give me some ideas.. here's what it said

Here are several potential trading trigger ideas that could capitalize on momentum and market psychology:

Failed Double Top/Bottom Pattern

When a second peak/trough fails to r

Read Full Story

-

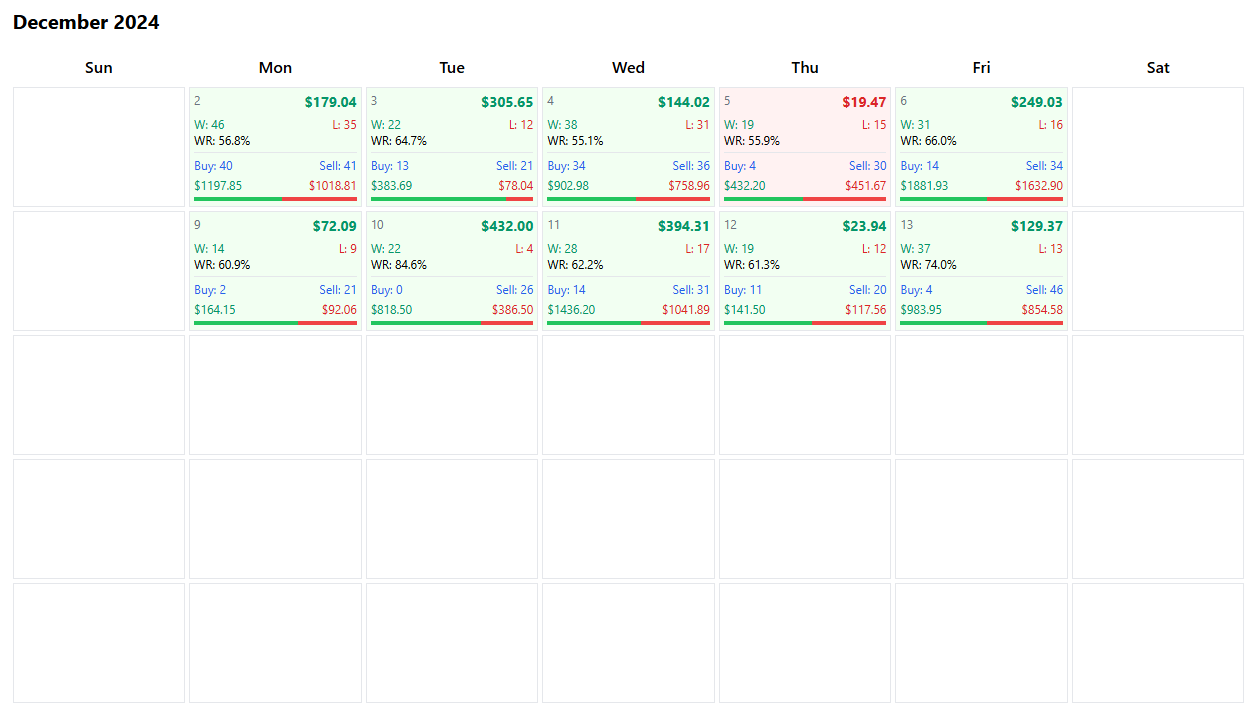

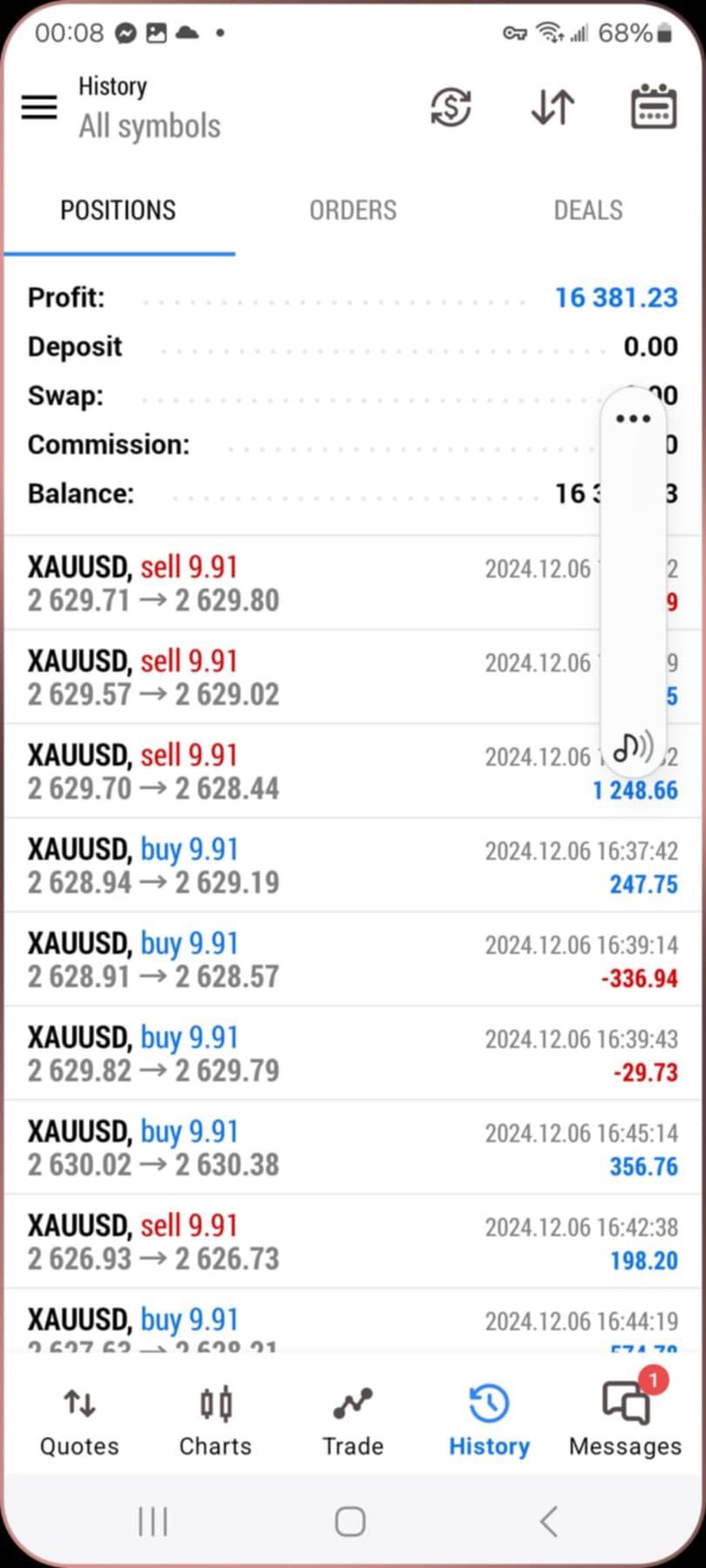

So I've been using the Dow Strike trading robot now for a couple of months and here are the results! 37 days of trading, 34 profitable and 3 losing.. made a total of $12,821.58 on a $100k account.. that's a 12.8% return in 2 months! It's particularly active from the US open and can open up 20-50 tr

Read Full Story

-

I have an associate, some guy I met online who I talk to about trading... he's an interesting character and one of the best traders that I've ever known. I'd like to say he's a friend as we do share a bit of information about each other besides our interest in trading but I've not met him in person

Read Full Story

More Articles

Yesterday, I showed how the FTSE fell when it reached the pivot level and dropped like a stone. Today, the market started below the pivot and as it was heading back towards it (that's the blue line in the chart below) at 7.45am UK time and then retraced, I saw that as an opportunity to enter short... so I did. The market did go as low as 6022 from my entry price at 6041 before shooting up... up to the pivot and then some more to take me out for -20! Oh well, I guess it can't always work!

May 4, 2011

No Comments Full Story

I found a brilliant little tool that scans your website and figures out what it's all about from the words are frequently used and draws a nice little graphic. So if anyone now asks me what my blog is about, I'll just show them the below picture:

May 3, 2011

No Comments Full Story

I had a really nice short in the GBPUSD market today with a trailing stop. I closed out early for 56 pips however when the market was retracing.. it retraced 25 points before it fell heavily (another 50 points) to 16500.

My actual exit is a trailing stop loss and it would have not hit it before it fell. The old trading adage 'cut your profits short and let your profits run' is a key principle to be successful in trading and I'm annoyed by myself that I broke the rule.

The chart is shown be

May 3, 2011

No Comments Full Story

« Older Entries

Newer Entries »