-

I was looking at triggers for a trading strategy and asked AI to give me some ideas.. here's what it said

Here are several potential trading trigger ideas that could capitalize on momentum and market psychology:

Failed Double Top/Bottom Pattern

When a second peak/trough fails to r

Read Full Story

-

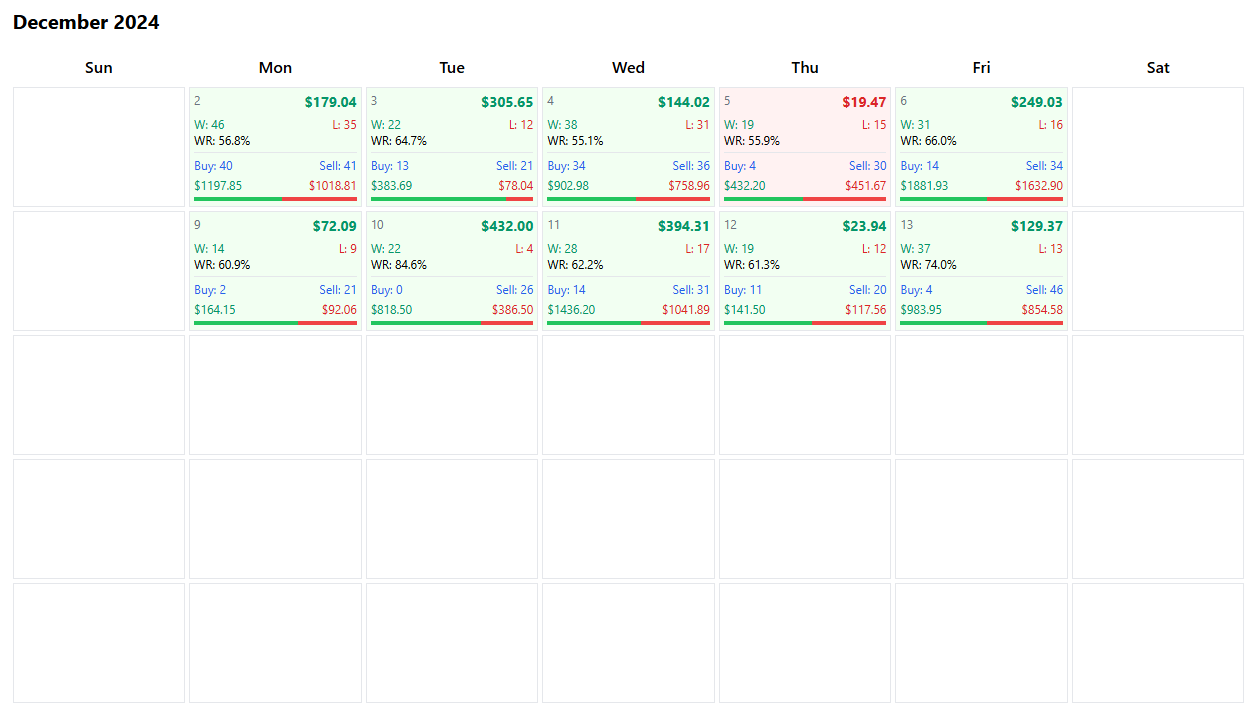

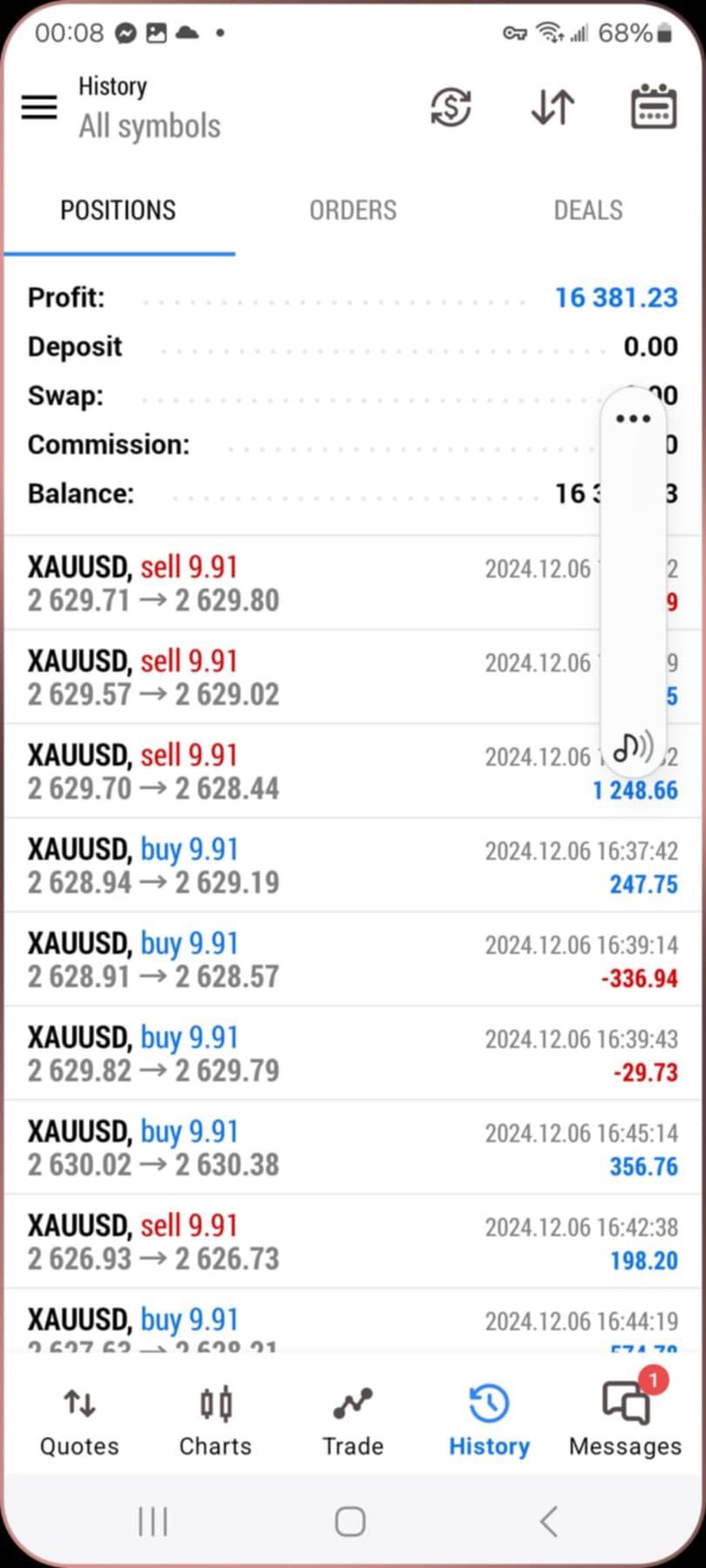

So I've been using the Dow Strike trading robot now for a couple of months and here are the results! 37 days of trading, 34 profitable and 3 losing.. made a total of $12,821.58 on a $100k account.. that's a 12.8% return in 2 months! It's particularly active from the US open and can open up 20-50 tr

Read Full Story

-

I have an associate, some guy I met online who I talk to about trading... he's an interesting character and one of the best traders that I've ever known. I'd like to say he's a friend as we do share a bit of information about each other besides our interest in trading but I've not met him in person

Read Full Story

More Articles

I realised that although I had taken screenshots of the DDFX charts over the past couple of weeks, I hadn't posted them all up on the blog. So here are a couple of annotated charts taken using the DDFX system:

EURJPY - 22nd to 28th July

You can see where I was uncomfortable with taking the short signal. I didn't like how the sell arrows were staggered and by the time I got all 3 arrows, the market had already moved somewhat too far already. Shortly afterwards, I get a 'buy' signal... thoug

August 8, 2011

No Comments Full Story

With the stock markets looking weak, Oil is said to follow. I had entered a short on a previous day low and also under the round number at 9100. My order was 9090 and it got hit. However, soon after this the market went up and it wasn't even certain as to whether this trade would go the right way. With breakout trades, I should have perhaps saw that this wasn't going anywhere and closed out before my stop was hit. However, the market moved 20 points above my stop before it did stop and reversed

August 4, 2011

No Comments Full Story

The below is the daily chart of the DOW and that it had made a double top formation a few days back. Following this, the market started going lower and yesterday I was looking for a break at the previous low as indicated. This happened and I had a short at 12460

The market fell and was looking to fall soon but after a major break, I was expected a retracement to happen far later than it did and I ended closing on the retracement for 40 points only for the market to fall further in the US

July 28, 2011

No Comments Full Story

« Older Entries

Newer Entries »