Thinking too much and trading

I’ve heard that you don’t do yourself any favours if you think too much about a position when trading. In fact, there was something that the more academic a person is, the more they have to justify their decision before making the trade.. in the fast move world of trading, by the time your neurons have worked out what to do, the market has already moved and along that, the opportunity.

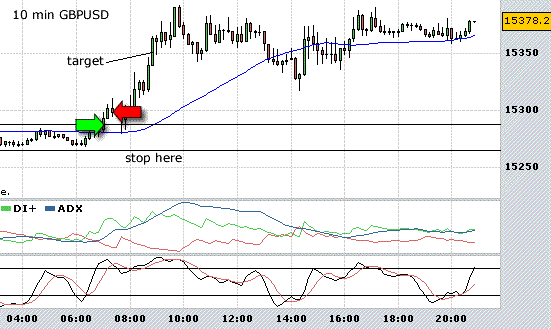

My trade set up today was a long if the GBPUSD went above 15287. The usual limit with this breakout trade is a 60 pip target with the stop being the bottom of the range formed before the UK markets opened. However, I saw that overhead resistance at 153000 had contained the market previously (and also because big round numbers usually are good support/resistance lines) so hung around nervously watching what the trade would do. As it breached 153000 I felt that it could pop and shoot high but then it started to move below this level and I felt edgey and hit the close position for 5 pips.

The market did go lower, back down 20 points before it went for 153000 again and this time it did pop.. almost 100 pips! If I had kept to the original plan, I would have had 60 pips in the bag!!

It just goes to show that if you have a systematic approach to trading you should keep to it… don’t think!! Don’t try and outsmart the market as you won’t.. the market will continue to do whatever it wants to do. A lesson learnt my side… however, as mentioned, the market will do what is wants to do and another time.. in hindsight, the market won’t pop and shoot up but tank and hit my stop and then I’ll be thinking.. “if only I intervened!”