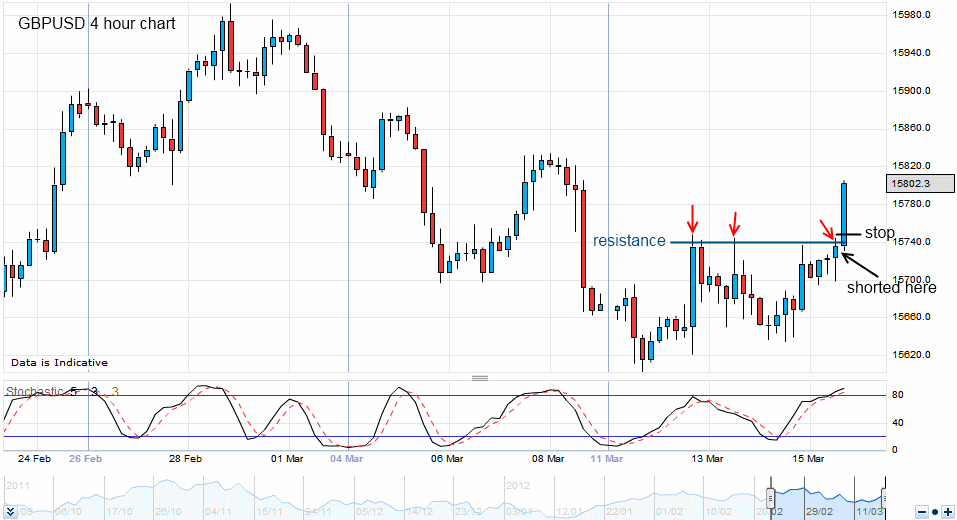

GBPUSD – Going Long when you already have a Short position

Look at the 4hour chart below of the GBPUSD forex pair (or cable) and you can see the resistance line. The arrows show where the price action had hit this line and bounced off it.. on the third time of this happening, I shorted with a stop just above the break level. As you can see, I lost on this one and took a 20 pip loss.

However, I also knew that objectively, that a break of the resistance could have been a great break out trade.. as you can see, it was indeed but being in the trade and losing, I found that I was unable to go long. It was not actually possible for my brain to register going long and against my previous position. From a logical perspective, I understand why… why would one go long when he has a short position? Trading is a probability game and the only way to win this is to play all the hands but obviously it isn’t always easy!

Obviously a bit disappointed here, the break has already yielded 50 pips if I had taken it (and I would have taken it if I didn’t have my short position)