Confusing Long Term vs Short Term trades – Trading the Dow Jones

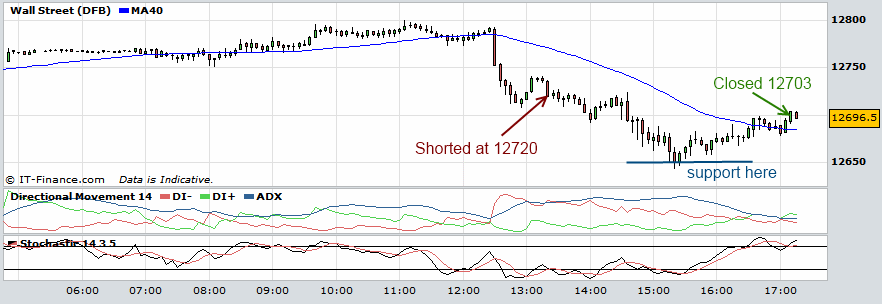

I had spotted that the Dow Jones had made a double top and I shorted it as it retraced and headed downwards at 12720. At this time I was thinking that this could be a nice longer term trade as I anticipated seeing the Dow decline over the coming weeks and possibly months.

I knew that there was support at the 12650 level and if it were a daytrade, this would have been a good place to take profits and take 70 points.. not a bad days work. However, when it bounced, and started to eat into my profits, I found this rather difficult to take and I ended up manually closing to bank a measly 17 points.

As I write this, the market looks to be declining again which is going to be really annoying if it penetrates todays low from here and beyond.

It’s so important to define your strategy… and STICK TO IT! I do find that this is becoming the difficulty when it comes to trading.. I need to stop messing with my plan and just leave the trade to go.